What time will trading on the stock exchange end? Opening and closing times of world stock exchanges

Good afternoon friends! I believe that many of you are already trying on the role of an active stock exchange player, since making money in this area of finance is not only convenient, but also absolutely realistic.

Only the lazy are not familiar with the topic of Forex today. One of the most famous centers of international exchange trading, in particular for currency transactions, is the American exchange. Here you can, without leaving your seat, get rich or quickly waste your starting capital. Therefore, I will devote a few words to what time the American stock exchange in Moscow opens, and when it is better to be ready to conduct trading operations.

So, translated into Moscow time, trading on the New York Stock Exchange begins at 16:00 Moscow time. Since all players wait for this time after a break from the previous trading day, the period from 16 to 18 hours sees the maximum surge in market activity. But at 18:00 the European session closes, and therefore many participants are trying to make the most of their positions in the period from 17:30 to 18:00 Moscow time.

Thus, we can say that the period from 16-00 to 18-00 is characterized by the greatest activity, because the American stock exchange begins its work, and the European ones are just finishing their lunch break.

There are also key differences in the game, which are related to the fact that the American session has earned a reputation as an unpredictable and even aggressive trading platform. Due to sharp exchange rate fluctuations, you can earn decent money here, or spend your entire deposit in the shortest possible time. For this reason, a number of experts do not recommend this platform for novice traders, advising instead to pay attention to calmer Asian markets.

Most often on the New York market, traders work with currency pairs, of which the most popular is - who do you think? Well, of course, His Majesty the US dollar. But, if you decide to turn your attention to trading using the US or Canadian dollar, then there is no better place to be.

Time differences in the operation of the main sites

Foreign exchange markets do not stop operating for 24 hours - this is precisely due to the difference in time and different time zones. Trading begins with the opening of the Australian platform, but its turnover does not allow it to have a significant impact on overall activity.

After 2-3 hours, the stock exchange of Tokyo and a number of other Asian cities begins to operate. At this time, it is deep night in most Russian regions, but at 9:00 Moscow time most European exchanges begin work. At the same time, Asian exchanges are still operating, which collectively has an impact on exchange rates.

From 16:00, as already mentioned above, the American stock exchange session begins. This is the most important time period, since it is here that the most important financial statistics are formed, which influence the course of trading on other platforms. Trading on the American site will last until 1 am, which is already 4 am in the Novosibirsk region.

The reader may rightly ask: are there really no breaks in stock exchange activity at all? Of course, the exchange stops its work during the weekend, when all sites without exception are closed.

Information for traders

In order to trade more successfully than other players, you need to take into account many external factors. The overall behavior of the stock market can change over time during the day, and you need to understand what influences its movement. last as follows (the time is indicated in Moscow time):

- Asian: 03-00 – 11-00

- European: 09-00 – 17-00

- American: 16-00 – 01-00

It is during the beginning of the American session that the most active trading takes place, since at the same time European participants return from their afternoon rest. Based on the received statistical data, American, as well as other corporate and private speculators are included in trading.

An interesting point arises at a time when European exchanges are already closing, but their American counterparts are still open. They continue to trade independently and, given limited liquidity, can move exchange rates virtually at their own discretion.

This transition time between sessions is considered a “thin market.” These are the most dangerous intervals, during which the situation can change catastrophically quickly. Therefore, experienced traders recommend not leaving their own transactions unattended at such moments.

Friends, I hope this information was useful for you, since you decided to engage in stock exchange activities. This automatically means showing interest in the work of the American site. Be sure to consider timing differences as they result in market reactions and exchange rate changes. I will be glad to chat with you on the pages of new publications!

In order to better understand the economic processes taking place in the world and respond to important changes in a timely manner, it is necessary to monitor daily the movement of quotes on world stock markets, and for this a trader needs to know stock exchange opening hours in different countries of the world.

Exchange opening hours in winter and summer is structured in the tables below, the data is presented relative to Moscow time.

Exchange opening hours in winter

Exchange opening hours in summer

Previously, Russia annually switched to summer mode, moving the clock hands back by one hour, but in the summer of 2011 this procedure was canceled. A similar situation is observed in Japan and China - these countries also do not change their clocks all year.

Autumn in Europe and the United States is marked by the transition to winter time (clocks are set back) and, thus, trading sessions in Germany, France, Great Britain and other European countries, as well as the United States, take place one hour later than the trading session in Russia, Moscow time.

In the spring, the same countries move their clocks forward, as a result of which the trading sessions of Europe and the United States overlap an hour more with Russian trading.

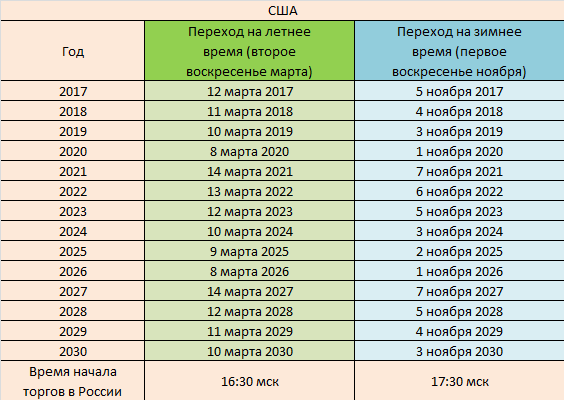

US clock change schedule

In America, the summer regime begins in March (the second Sunday - an hour ahead), the winter regime - in November (the first Sunday - an hour ago).

Transition schedule in Europe

European countries also switch to the summer schedule in March (the last Sunday in March - forward by one hour), and in October - to the winter schedule (the last Sunday in October - back by one hour).

How does the clock change affect the Russian trading session?

As a result, during the summer time period, the American session “overlaps” the Russian session for 1 hour and 15 minutes, thus, Russian traders have time to win back some of the overseas trading. Trading in the US closes at 00:00 Moscow time, which coincides with the close of the Russian evening FORTS session.

During winter time, the obvious disadvantages of canceling the clock change in Russia are obvious.

- The US trading session overlaps with the Russian one for only 15 minutes, resulting in the strongest volatility in the final 15 minutes. before closing (from 18:30 to 18:45).

- Europe will open later, i.e. at 12:00, which means that there will be no additional drivers of movement from 10:00 to 12:00 for the Russian Federation (as a result, the first two trading hours are marked by low volatility).

- The release of significant US macro statistics will now occur at 19:00 Moscow time - this is the time when the FORTS evening session begins after the main clearing. The result is increased activity in the first minutes of evening trading.

- During the winter period, the American session closes at 01:00 Moscow time, and the FORTS market is traded until 00:00 Moscow time. As a result, the last trading hour will be ignored in the evening and won back in the form of a gap in the morning session.

As was said above, when forex trading there are temporary points of special attention for traders - these are moments discoveries And closing stock exchanges peace. Depending on the time of day, volume and volatility currency pairs changes. This must be taken into account when bidding.

The table shows time points opening and closing of trading on these exchanges:

After the weekend on Monday, trading on the exchange begins at 00:00 hours By server time broker:

Looking at the time difference between your broker and time in your region, you will be able to determine when trading will open on Monday in your time zone.

For example, according to Moscow time, the exchange will open at the broker Alpari on Monday at hour nights ( 01:00

).

Average data diApazonesam in points for different currency pairs in different time periods:

Opening time Asian sessions - 3:00 Moscow time(00:00 GMT) until 12:00 Moscow time(9:00 GMT).

Large investment banks and hedge funds often use Asian session to move the market towards important stops and option barriers. Large Japanese exporters are known for often selling their dollar profit for yen, which provides additional movements in pairs.

Opening time European sessions - from 9:00 Moscow time(6:00 GMT) until 18:00 Moscow time(13:00 GMT).

London auctions are the largest in the world, occupying approximately 30%

from all ongoing trading, because the main terminals of the world's major banks are located there. High volatility reflects the peak of daily trading activity, as large trading participants complete the daily cycle of restructuring their assets at this time.

Opening time American sessions - from 16:00 Moscow time(13:00 GMT) until 01:00 Moscow time(22:00 GMT).

New York is the 2nd largest market, accounting for 19 %

total turnover on Forex. When the US stock and bond markets are open, foreign investors often convert their currencies, such like yen, franc and pound to US dollars, in order to be able to place them on the specified markets. When market hours "cross" the largest ranges have GBP/JPY And GBP/CHF.

Overlap time European And American sessions - from 16:30 Moscow time(13:30 GMT) until 19:00 Moscow time(16.00 GMT).

At this time, market activity reaches the greatest development, since at this time trading is going on two biggest world markets at the same time. This is the time 70%

all transactions on the foreign exchange market for the European session and 80%

all trades for the American session. For volatility lovers and those who are bored of looking at a screen all day, this is the best time to choose to trade.

Overlap time Asian And European sessions - from 10:00 Moscow time(07:00 GMT) until 12:00 Moscow time(09:00 GMT).

The least active period of time on the market. Trading is very thin during these two hours and this period can be used by traders wary of risks to their positioning for the European open.

Novice traders often ask the question “When is it better to trade - day or night?” It will be easier for you to get the answer to this question yourself by studying the features of the movement of charts during the day and night.

The following must be remembered:

“At night, quotes move smoothly in the channel, and during the day they are volatile in a trend.”

In other words, during the day the chart looks something like this:

At night like this:

By correctly assessing the differences and studying the strategies, you will increase the likelihood of profitable trades at any time of the day!

It is imperative to take into account the time of day factor when trading. Financial exchanges are a 24/7 market. When evening falls in one part of the world and market participants finish trading, in the opposite part everything is just beginning. Trading sessions follow one after another and continuously transform into one another. Depending on the time of day, trading activity in different currency pairs varies.

An experienced trader who knows which instruments are more volatile in certain trading sessions has an advantage over other market participants and trades more efficiently. Unlike other instruments, currency pairs can be traded non-stop 24 hours a day, five days a week (with breaks on weekends), which is a huge advantage over stock markets, which operate only a few hours a day.

Trading session schedule

There are 4 trading sessions. Asian, European, American, Pacific exchanges.

There are 4 trading sessions. Asian, European, American, Pacific exchanges. - From 03:00 to 11:00 Moscow time – Asian exchanges are open;

- From 09:00 to 17:00 Moscow time – European stock exchanges are open;

- From 16:00 to 24:00 Moscow time – American stock exchanges are open;

- From 23:00 to 07:00 Moscow time – Pacific exchanges are open.

summer time

summer time

Trading session schedule in winter time

Trading session schedule in winter time

It is clear from the figures that some trading sessions overlap each other. During such periods, markets experience increased activity and volatility. Many traders like to use these periods as the most predictable, effective and profitable.

Moreover, strong movements in the markets are often observed at the opening of the trading session and an hour before closing. This is due to the fact that many participants first open their positions and take profits on them towards the end of the day.

Features of trading during sessions

All of the listed exchanges have their own characteristics.

- During the Pacific session assets are flat and suitable for channel strategies.

- During the European and American sessions quotes are very flexible and are perfect for trend strategies.

- During the Asian session The market is moderately volatile and suitable for almost any trading style.

PACIFIC TRADING SESSION

The foreign exchange market starts with the opening of the Pacific session at 21-00 GMT. Its distinctive feature is that it is the lowest volatile and one cannot expect any sharp jumps.

Experienced traders try to refrain from trading during this period, but continue to monitor the market, the breakout of important psychological and historical levels, and also monitor the formation of new trends and price reversals. Traders try not to trade in large volumes during the Pacific session, since the dynamics of the quote are not always explainable.

When trading, trading instruments such as AUD/USD And NZD/USD, which are the national currencies of the countries of the Pacific region (Australia and New Zealand)

ASIAN TRADING SESSION

At 23:00 trading begins on the Asian stock exchange. First, the exchange in Tokyo (Japan) opens, and an hour later the exchanges in Hong Kong and Singapore are connected to it. Activity in the foreign exchange markets is slight but increasing.

The most active couples are currency pairs with JPY - USD/JPY, EUR/JPY, GMP/JPY. You should also take a closer look at the couples EUR/USD, AUD/USD. Typically, the Asian stock exchange sets the trend for the whole day.

Highest volatility during the Asian session due to its closure. In general, during the Asian trading session the market is more or less calm, however, special attention should be paid to the market from 00-00 GMT to 01:00 GMT, since at this time the main indicators for Japan are released and Japanese banks record the state of the balance sheets of financial institutions.

EUROPEAN TRADING SESSION

Today, there are many financial centers in Europe: Frankfurt, Paris, Moscow and of course London, which accounts for approximately 30% of the total volume of financial markets.

An important feature of the European trading session is that it partially overlaps with the Asian session in the morning, and in the evening with the American. Despite the fact that volatility is increasing, there is no aggression in the market.

The most important news is published from 07-00 GMT to 12-00 GMT. However, do not miss or underestimate the speeches and comments of leading political and economic figures who may speak later and have a significant impact on the market.

Throughout the trading session, there is high volatility and the range of trading instruments that can be traded increases significantly. One of the most popular assets is currency pairs containing EUR, GBP, CHF. For example: EUR/USD, GBP/USD, CHF/USD, EUR/JPY, GBP/JPY.

AMERICAN TRADING SESSION

Another important session, trading in which begins at 12-00 GMT (in summer) and at 13-00 GMT (in winter). It must be remembered that the American trading session is not only America, but also such economically developed countries as Canada and Brazil.

The American trading session is extremely volatile and aggressive, since market participants pay great attention to news releases. During the American session, the previously established trend can be either continued or reversed. Key news is published mainly from 12-00 GMT to 14-00 GMT and greatly influences the movement of rates.

During the American session there is high trading activity. Particular attention is paid to currency pairs that have USD And CAD. JPY volatility is also increasing. Those traders who like the sharp movement of quotes try to trade on such cross rates as GBP/JPY And GBP/CHF.

The key to success in trading in financial markets consists of many important factors, and one of the key components is the ability to act correctly during different trading sessions. The specifics of trading during different trading sessions will allow the trader not only to use his time rationally, but also to effectively distribute his forces and resources. That is why knowledge of the trading session schedule is a competitive advantage and an important component of successful trading in the foreign exchange markets.

It is important to remember that a trader should not chase profit or try to earn as much as possible, the market will always provide a chance to earn money, the main thing is to wait and not miss this opportunity!

Global warning.

All information set out above is for informational purposes only and in no way constitutes financial guidance. The transactions proposed in this manual may be considered high risk transactions and their execution may be very risky. If you purchase the financial instruments and services offered, you may suffer a significant loss of your investment or even lose all funds in your account.

Amid reports of impending US sanctions against Russia, the dollar exchange rate at the opening of trading on the Moscow Exchange exceeded 66 rubles, which happened for the first time since November 2016, according to data from the Moscow Exchange.

The euro exchange rate has also changed. The European currency rose to 77.3 rubles. Such indicators were last recorded in April 2018. As of 11:00, the euro exchange rate is 76.66 rubles, and the dollar is 66.18 rubles.

Ruble bulls failed to win back the depreciation against the dollar and euro

The ruble lost 73 kopecks against the dollar, and only 53 kopecks against the euro. News about the introduction of new American sanctions against Russia on August 22 brought a negative mood to the ranks of stock traders. The formal reason for their introduction was accusations against Russia from the UK about Moscow’s involvement in the March poisoning of the Skripals in Salisbury. A bill on sanctions against Russian state banks and public debt has been introduced into the American Congress. It may not be adopted, but it potentially threatens to ban Russia from making payments in dollars.

Against this background, the ruble updated its minimum since August 2016 against the dollar - 66.73 rubles. The April 2018 record against the euro was also broken - 77.33 rubles. As the Russian currency approached the level of 67 rubles per dollar, speculators began to take profits from the growth of the currency.

The average exchange rate of the US dollar with a settlement date of “tomorrow” based on trading results at 19:00 Moscow time was 66.1371 rubles

The weighted average exchange rate of the US dollar with a settlement date of “tomorrow” at trading on the Moscow Exchange as of 19:00 Moscow time increased compared to previous trading by 16,432 points (1 point corresponds to 0.01 kopecks) and amounted to 66.1371 rubles.

The minimum exchange rate of the US dollar was 65.7725 rubles, the maximum - 66.7275 rubles. By this time, 39,370 transactions had been concluded. The trading volume amounted to RUB 281,274.14 million, which is 40% higher than the average for the last month. The last transaction was made at the rate of 66.3975 rubles. per US dollar.

From January 8, 2013, the Moscow Exchange extended the closing time for trading on the foreign exchange market until 23:50 Moscow time. Bidders still have the option of leaving the auction early: at 17:00 Moscow time or 19:00 Moscow time.