What is the importance of spreads in Forex? Forex spread - as one of the most significant fundamentals in the foreign exchange market

A fixed spread when trading on the Forex market can be useful for novice traders who do not want or do not yet know how to calculate the optimal entry conditions for themselves. They can also be used by connoisseurs of medium- and long-term trading.

If you belong to one of the listed categories of traders, you will definitely like today's rating. Next, we will look at the 9 best forex brokers with a fixed spread.

Top brokers

So, the table below shows the dealers that we will talk about in more detail today.

| Broker | Minimum fixed spread, points |

| 2 | |

| 1,6 | |

| 3 | |

| 2 | |

| 1 | |

| 3 | |

| 2 | |

| 1.5 | |

| 2 |

Now let's talk in more detail about each of the companies and find out which broker is better to work with.

Alpari

You can work with a fixed spread on the website only on one trading account – Nano.MT4. This is a cent account with the following trading conditions:

- Currencies – USD (cent), EUR (cent);

- There is no minimum deposit;

- Leverage – fixed 1:500;

- Instruments – 33 currency pairs and 2 metals;

- Minimum/maximum transaction volume – 0.1/10 lots;

- Stop Out – 10%.

The mobile dealing function is also available, but only for closing a transaction.

You can work on standard and ECN accounts with the Alpari forex broker only with floating spreads.

RoboForex

Unlike Alpari, RoboForex offers 3 account types with a fixed difference between the bid and ask prices. The table below describes the main conditions for working with these accounts.

There are many similarities in the said accounts, many of which you can find on the dealer's official website.

Note that Robo offers some of the most favorable conditions for trading on an ECN account. And in addition to favorable spreads, the company offers a number of benefits for its clients and protection of their funds.

Instaforex

This fixed spread forex broker offers 2 types of trading accounts: Insta.Standard and Cent.Standard. They differ from each other only in that the second allows you to open micro-transactions with a volume of 0.0001 lots or more. Trading is carried out in cents.

You can work with Insta.Standard and Cent.Standard under the following conditions:

- The minimum deposit amount is 1 USD;

- Spreads – from 3 to 7 points;

- There are no commissions;

- Leverage – from 1:1 to 1:100;

- Margin Call/Stop Out –30/10%;

- Interest rate – 13% per annum. Accrued on the last day of each month. Valid only on active accounts. Inactive accounts receive 6%.

The difference between the Bid and Ask prices here is the highest among the dealers on today's list. But otherwise the conditions are quite suitable for work.

STForex

The company offers its clients 3 types of accounts: Cent, Classic and Pro. The last one has floating spreads, and the first 2 have fixed spreads. At the same time, the conditions on Cent are similar to Classic, only trading is carried out in cents.

On these accounts you can only trade currency pairs, as well as gold and silver. CFDs on stocks, cryptocurrencies and indices are only available on the Pro account.

The minimum difference between Bid and Ask of 2 points is available only on the EURUSD pair. You can also trade with relatively low spreads of 3 points on EURGBP, USDJPY and GBPUSD.

BCS Forex

The company offers to work with four accounts, but like many brokers, not all can use the spreads we are interested in today. To be more precise, a fixed commission is only available on the Pro account.

The Pro account opens up classic forex trading on the MetaTrader 4 platform with 135 available instruments. Let's look at what other trading conditions the BCS Forex Pro account offers:

- Minimum deposit 1 USD;

- shoulder – 1:1–1:200;

- minimum transaction volume – 0.01 lot;

- level of limit/stop orders – from 6 points;

- margin call/stop out – 100/20%;

- a training account is provided;

- Available account currencies are USD, EUR, RUB.

High-quality conditions from a reliable broker. What else do you need for comfortable trading?

Amarkets

An excellent broker that allows you to trade a variety of instruments on different accounts. We are now interested in only one account – Classic, since on the others there is no fixed difference between the bid and ask prices.

So, when working on a Classic account, you will open transactions using Instant execution technology, that is, an order will be opened only at the price that you see in the terminal. And although the average speed of opening transactions is the highest among accounts, you are unlikely to notice it. Contracts are concluded on average in 0.099 seconds.

- Leverage – up to 1:500. Depends on the replenishment amount;

- five-digit quotation;

- minimum lot – 0.01;

- margin call – 50%;

- stop out – 20%;

- The minimum deposit for a transaction is 2 USD.

Details of trading with the Amarkets broker can be found in the review or on the company’s official website.

Wforex

World Forex is not as popular a broker as Alpari, InstaForex or other fixed spread Forex brokers that we have already mentioned. However, this does not prevent the company from providing quality trading conditions.

The minimum spread on the platform is 2 points. But unlike STForex, with this value you can trade not just one currency pair, but 3: EURUSD, USDJPY, EURGBP.

The dealer only offers one account type, so all traders trade under the same conditions.

Forex4you

The main disadvantage when working with this company is the long time it takes to open a deal. The fact is that fixed spread is provided only on two trading accounts: Cent and Classic. Both with Instant execution type, and the execution speed of trades is 1.37 and 1.3 seconds respectively, which is 13 times longer than Amarkets.

Another disadvantage is the limited storage period for transaction history. On a cent account it is 1 month, on a classic account – 3.

Otherwise, there are no complaints about the platform:

- Leverage from 1:10 to 1:1000;

- minimum contract volume – 0.01;

- spread from 1.5 pt. on the Cent account and from 2 pt. on Classic.

VTB 24

Bank broker for experienced traders. You cannot trade with high leverage here. Only 24 currency pairs are available for trading, and the minimum deposit is 50,000 rubles.

Spreads on the platform from 2 pips are the favorite value of most of the dealers on today's list.

If you want to work with a reliable Russian bank dealer, who will also pay taxes for you, we recommend registering a trading account on the VTB24 website. Just keep in mind that to do this you need to go to the bank office.

This is what our selection looks like today. If you prefer to work with fixed spreads, be sure to study these dealers in more detail. We are confident that you will be able to find the optimal dealer for you.

Spread (from English spread - expansion, stretching) is the difference between the purchase price and sale price of a currency. The spread is measured in points or pips. Why do you need a spread in Forex? It’s simple – it’s a fee to the broker, a commission for the intermediary services provided to the trader between him and the financial market.

When choosing a broker, novice traders should pay attention to the size of the spread that is offered to him. The lower this value, the better for the player. Commission is the main source of income for a broker, along with SWAP, profit from paid courses, strategies and webinars for traders.

The size of the spread depends on the volatility of the market and the financial instrument. On some currency pairs it is lower, for example, on the same euro-dollar, since this financial instrument is very popular among traders due to its high liquidity. On exotic currency pairs, for example, USD/RUB, the spread will be higher, since the demand for this currency is much less.

Every time a trader invests in a trade, the broker makes money on the spread. When purchasing, the intermediary earns at the moment the transaction is opened, since the transaction is opened at a price slightly higher than the market price. When selling - at the time of closing the transaction. Beginners are often perplexed - they opened a trade, but it is already in the red. It was the broker who wrote off the spread amount from the trader's account. The broker, as an intermediary company, makes money in any case - it does not matter whether the trader made a profit or loss.

Types of spread

Modern brokers offer their clients several types of spread, which are selected when opening an account. There are only 3 types of commission:

- Fixed spread – as the name implies, the broker sets for each instrument a fixed commission amount, which will be charged to the client when opening transactions. With a fixed spread, you do not need to constantly monitor the commission; this is the main advantage. The disadvantage of this type of spread is that in short-term transactions it will “eat up” most of the profit. Therefore, a fixed commission is more suitable for medium and long-term trading, where a couple of points do not matter much;

- Floating spread – the commission amount constantly changes depending on the liquidity of the market. With strong, long-term BOs, the size of the floating commission is reduced to minimum values, which is very beneficial for the investor. The disadvantage of a floating spread is that during periods it increases to 20-30 points. This makes trading simply pointless, since the commission will cover the profit received due to price movement;

- Commission per lot - the trader pays a commission depending on the volume of the transaction, for example, $50 from $100,000. A floating spread is added to the lot commission; as a result, the total fee is no different from other types of commissions.

How to choose a dealing center with a favorable spread?

(or brokers) make money through the spread, that is, through margin trading of small clients. If a trader, when choosing a broker, sees that he is offered zero spreads, then it is worth studying the trading conditions in more detail. In financial markets there are often companies that attract clients with zero commissions. But at one point such companies close and disappear along with the traders’ money.

Advice: The determining factor in choosing a broker should be the reputation and reviews of the company (and only last but not least, the spread).

Some companies actually do not charge the investor the difference, but make a profit due to additional commissions, which are not emphasized when replenishing the account. Many brokers reduce the difference to zero, but at the same time set certain restrictions on trading. In other words, the broker will not offend himself, he will take his own. The trader’s task is to find a middle ground between the company’s reputation and the size of the spread.

Advice: If you have not yet decided on a brokerage company, we advise you to choose large companies, such as InstaForex, which have proven themselves in the market.

Where can I see the spread?

Most traders trade Forex through the MetaTrader 4 trading terminal. The spread value can be determined in several ways:

- On the “Market Watch” tab - next to the names of currency pairs, data on the ASK and BID prices, as well as the spread value, are displayed. If this information is not available, then you need to right-click anywhere on the tab and select Spread.

- On the “New Order” tab - in the window with data about the new order, all the necessary information about the financial instrument is displayed, including the spread value.

Indicators for determining spread

Metatrader 4 is a fairly flexible investor tool that allows you to implement new technical indicators and trading systems to facilitate chart analysis. Programmers have developed many indicators that independently determine and display the spread value in a convenient form on the chart.

Spread (English spread "spread") - the difference between the best prices for the purchase (ask) and sale (bid) of any asset (currency, shares, futures, options, etc.) at the same point in time on the stock market or currency exchange.

Buy cheaper - sell more expensive. This rule has been familiar to people since 687 BC. e. – the time of the appearance of the first gold money. Even then, clever merchants managed to pay less for goods.

They ground the coins in a circle, keeping some of the gold for themselves. And full-fledged banknotes were accepted from buyers. This is how the precious metal ended up in the pockets of traders. Over time, to protect the coins, their edges began to be jagged. This made it possible to recognize money with less weight by touch and stop fraud.

And although coins have not been minted from gold for a long time, the tradition of making the edge ribbed has been preserved. Just like the rule of buying and selling at different prices, which is actively used in the Forex market. The difference between the purchase and sale prices is called a spread.

Ask and Bid – learning the Forex alphabet

Before studying the spread in detail, you need to understand how it is formed. The Ask and Bid lines will help you with this. It looks like this on the graph (Figure 1).

Enlarge image

In the Forex market, there are two prices at the same time: supply and demand. The best price at which traders are willing to buy an asset is called Ask. And the one for which you can sell it is Bid.

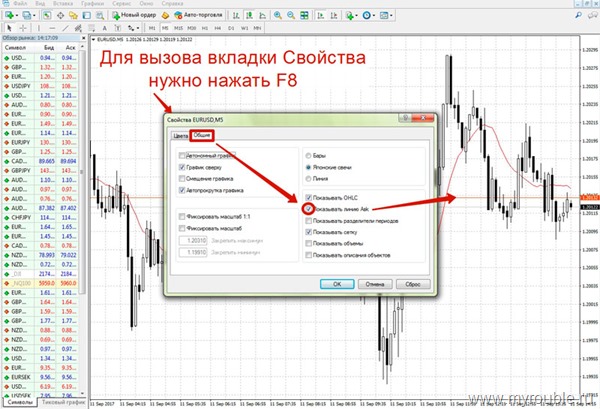

And here lies the first trick of brokers: the Ask price is not reflected on the chart by default! Thanks to this, the trader successfully forgets about the price difference and... makes money. You can enable the line in the Properties tab (F8 – General – Show Ask line). (fig2)

Enlarge image

Let's look at an example. Trader Kolya wants to sell €1000, but there are no people in his town willing to buy the currency. A broker (intermediary company) gives him access to a huge market with thousands of buyers. And he offers to sell the euro for $1,175.

Meanwhile, elsewhere in the world, trader Petya wants to buy just €1000. And that same broker sells him currency to Colin for $1,221.

Broker's income: $1,221 – $1,175 = $46. This is the spread. Only it is measured not in currency, but in points. Why? We'll tell you further.

How the spread is measured - convert points into money

What is a clause? This is the change in the last digit of the quote. Note! There are 2 calculation systems: according to the old one, the quote can have 2 or 4 decimal places. For example, 108.57 for USD/JPY and 1.1987 for EUR/USD. And according to the new one - 3 or 5 digits (108.578 and 1.19878, respectively). A point is a change in the 2nd or 4th digit after the decimal point. (Fig.3)

Enlarge image

The size of the spread depends on the amount you are trading. The higher it is, the more deductions to the broker. Depending on the transaction amount, 1 spread point can be equal to $1, or maybe $1,000!

For example, when trading 1 lot, each point (that is, 0.0001) will be multiplied by 100,000. When entering the market with 2 lots - by 200,000 and so on. Therefore, if you calculate the spread incorrectly, you can lose your entire deposit. More on this below in the Leverage section.

Calculating the true size of the spread is difficult. After all, it depends on several conditions:

- Spread type (fixed or floating). The fixed spread is equal to the number of points pre-agreed in the trader’s agreement with the broker. Floating – can change every second. The first one is better suited for trading on news and at night. And the second is for long-term transactions (for a week, a month, etc.).

- Lot size. A lot is a portion that you trade. Standard 1 lot = $100,000 (99 of which are given by the broker under the terms of leverage 1:100). But no one prohibits the “diet regime”! You can trade 0.1 and even 0.01 lots (10,000 and 1,000, respectively).

Attention! The floating spread “for convenience” is indicated by 0,000 points. But this does not mean that commissions are not charged on the pair! This is a signal to clarify the current size further.

Leverage and spread calculation

And now about leverage. Entering Forex with a hundred bucks is an unrealistic idea. After all, central banks and corporations will not buy trillions bit by bit! The minimum transaction amount here is $100,000.

But what if 99% of traders do not have such free money? In this case, a broker – an intermediary company – is ready to lend its shoulder. And this is called “leverage” - credit. Its size can be 1:1, 1:10, 1:50 and even 1:500.

What does it mean? The broker adds the missing amount to your deposit to reach the required 100,000. And the number after the colon indicates how much the trader himself should invest.

For example, 1:100 means 1 lot (100,000) divided by 100. That is, you open a trade by investing $1,000 (100,000/100= 1,000). The broker adds another $99,000. You can already trade with this amount!

But don’t worry, out of the 99 thousand credit you won’t lose more than your deposit. As soon as the loss approaches the amount of the initial investment, Stop Out will work. And the broker will take his money. Got it? Now let's get back to calculating the spread.

Example: EUR/USD transaction (rate 1.1920), 1 lot (remember that this is $100,000). 1 point according to the terms of the transaction will be equal to: ($100,000*0.0001)/1.1920 = $8.4.

Where did the number 0.0001 come from? This designates 1 point in a four-digit quote (4 digits after the decimal point). 0.0001 – price movement step on the chart. For example, 1.1920 – 1.1921 – 1.1922, etc. Each time the amount changes by exactly 0.0001.

The spread for the euro/dollar pair at Forex brokers is 0.5–3 points. This is stated in the Contract Specifications sections on company websites. We multiply this number by $8.4 (the cost of a pip in our trade) and get $4.2–25.2.

Second example: USD/JPY (dollar/yen), also 1 lot, but at the rate of 110.65. 1 point here would be equal to ($100,000*0.01)/110.66 = $9. 1 point is indicated by the number 0.01, since the quote has 2, not 4 decimal places. The USD/JPY pair has a spread of 2–4 points. These are the numbers you will find in broker documents approved by the exchange. In our case, it’s $18–36.

You can compare spread sizes in points for different brokers using the following table.

Comparison of spread sizes for TOP brokers in points

| Broker | Spread on EUR/USD | Spread on GBP/USD | Spread on USD/JPY | Spread on USD/RUB | Spread on silver XAG/USD | Spread on gold XAU/USD |

| Alpari* | 0,8 – 1,3 | 1,3 – 2 | 1,2 – 1,4 | 18 – 19 | 22 – 25 | 26 – 32 |

| Teletrade** | 1,5 | 1,6 | 1,7 | 40 | 5 | 40 |

| RoboForex*** | 2 | 3 | 3 | 40 | 3 | 100 |

| Forex4you | 2 | 3 | 2 | – | 5 | 100 |

| InstaForex | 3 | 3 | 3 | 40 | 40 | 60 |

| FxPRO | 0,6 – 1,4 | 0,9 – 2 | 0,6 – 1,6 | 40 | 3 | 30 |

| FreshForex | 2 | 3 | 2 | – | – | – |

– the spread size is not specified in the Contract Specifications;

* floating spread during the European session (10:00 – 17:00 Moscow time);

** floating spread, minimum value indicated;

*** fixed spread on a cent account.

Note! The floating spread can change significantly on the news and at night (increase by 10 - 15 times).

Insignificant amounts, you say? Yes, for high-value assets (those that are bought and sold well) it can be ignored. But there are only about 10 such assets! You will find their complete list below. And now it’s time for the third truth.

Liquidity comes first

What is liquidity? This is the ability of a product to sell and buy well.

Let's take an example from life:

Which car do you think will be more liquid on the secondary market, Hyundai Solaris or Porsche Cayenne? Answer: Solaris. Let's look at the process of selling both cars through the eyes of the seller. There are more Korean cars on the market than German ones. The price for Hyundai is much lower, which means there will be an order of magnitude more buyers for this brand. In other words, if you had both brands and decided to sell them, then it would be easier for you to find a buyer for Solaris at the right price. Cayenne will be sold for a long time at the price you need. And to sell it faster, you will have to greatly reduce the price, which will be unprofitable.

Now let's look at the same example, but through the eyes of the buyer. Let's say you have 500,000 rubles. for a used Solaris for his wife and 2 million rubles. for a used Caen for your loved one. There will be 100 Solaris at this price, of which it will be easier for you to choose a car that is not damaged and technically sound. But there will be about 20 Caen at this price, but upon closer examination, many of them will disappear, since they will either be broken, or repairs will require considerable investment, in other words, it will be much more difficult to find an unkilled Caen.

In the Forex market, the equivalent of Solaris is the euro/dollar pair. Every 3rd trader in the world (37%) trades this asset. This means that it has high liquidity and brings regular income to the broker. Therefore, the spread here is minimal.

Unlike the USD/ZAR pair, which in Forex is the equivalent of Caen (dollar/South African rand). Have you heard of the rand before? Now imagine how often they buy it, even if the name of the currency doesn’t tell you anything. It is clear why the spread here is 80–250 points (taking into account the low exchange rate, this is $60–190 with a volume of 1 lot). However, liquidity depends not only on the type of asset! (Fig.4)

Enlarge image

Influential factors include time of day, holidays and news releases. Let's remember the Swiss franc, which collapsed during the New Year holidays! And let's talk about how the spread changes in different periods.

How to protect your deposit from spread jumps - 2 “golden rules”

Spread (even fixed) tends to expand. Your agreement with the broker always states that in cases of force majeure it may increase. This is exactly what happened to the Swiss franc in January 2015 due to the National Bank’s decision to stop cash injections to support the currency. Then the spread widened from 3 to 300 points in 1 hour and traders suffered enormous losses due to the execution of Stop Out.

And with a floating spread, jumps occur 90% more often than with a fixed spread. The gap between bid and ask widens:

- at night up to +50 points (especially from 21:00 to 00:00, until the Tokyo Stock Exchange is open);

- on holidays (liquidity drops due to the small number of players on the exchange);

- when important news is released (the ask price rises sharply, but the bid remains in place, or vice versa).

What follows from this?

Rule #1: If you want to win by using a lower floating spread, close trades before important news comes out. Here are some examples of such important news:

- Nonfarm every last Friday of the month,

- speeches by heads of central banks;

- presidential election results,

- decisions on joining/leaving the EU, etc.

Rule #2: always check the current spread. This can be done on the broker’s website or by installing a program that displays this parameter in the MetaTrader window.

The following video will help you consolidate your knowledge.

Spread or commission - 3 assets on which you can get rich or lose everything

Have you heard of zero spread accounts? Tempting stuff! Up close, everything turns out to be not so rosy, because the 0 spread points are compensated by the commission. And you pay the same amount, only it is called differently. But there are assets for which the commission and spread levels are strikingly different (you can save up to 50%):

- USD/CAD (Canadian dollar): on accounts with zero spread the commission is 2 points, and on traditional ones the spread is 4.

- XAG/USD (silver). This is the opposite option, when on accounts with zero spread the commission is 2 times higher than the traditional spread. Accordingly, the commission is 10 points versus 5 points of the spread.

- BTC/RUB (bitcoin/ruble): commission – 0.1%, spread – 0.8%.

In what cases is commission also more profitable than spread?

- If a trader trades pending orders. That is, it sets a condition to automatically open a deal when the price reaches a certain level. In this case, spread may cause the order to fail. For example, news is expected on the UK's exit from the EU. The trader assumes that the pound will fall against this background. But he knows that at such moments the servers are overloaded, and it is almost impossible to open an order. Or is at work, away from the computer. The way out of the situation is to trade on GBP/USD. According to it, if the price falls below 1.3398, a Sell order is opened. But there is still a spread of 8 points! And in fact, the trade will not open until GBP/USD reaches 1.3390. But the quote may not reach this level.

- Pips traders (scalpers) also prefer commissions. After all, if a trader receives 3–5 points, it is simply not profitable for him to give 4 for a spread! Whereas the commission will be equal to 1 point.

- When trading intraday (when orders are not left overnight). Due to the spread, the price often does not reach the Take Profit or knocks down the Stop Loss. After all, this is a kind of “trailer” that the deal pulls behind it. But with the commission there is no such problem.

Dangerous and safe transactions - how spread can “eat” your deposit

In early 2016, Chris Davison conducted a formal study on the profitability of Forex trading. According to its results, only 30% of traders regularly earn money. And what an interesting coincidence! Only 30% of respondents check the spread size before opening a trade. Maybe there is a connection between these numbers?

TOP 10 assets with low spread

There are about 10 assets with a low spread size (up to 5 points). This:

- AUD/USD – Australian dollar (“Audi”) against the US dollar;

- GBP/USD – British pound to dollar;

- EUR/CHF – euro/Swiss franc (“chief”);

- EUR/GBP – Euro/English pound sterling;

- EUR/JPY – euro/Japanese yen;

- EUR/USD – euro/US dollar;

- NZD/USD – New Zealand dollar (“kiwi”)/US dollar;

- USD/CAD – US dollar/Canadian dollar;

- USD/CHF – dollar/Swiss franc;

- USD/JPY – dollar/yen;

- XAG/USD – silver/dollar.

Usually, these tools are enough to conduct profitable trading. But there are times when there is a reason to trade other assets!

Where can you get a $200 spread?

High spread rates are usually set for exotic currency pairs. As well as gold, corporate shares and cross pairs (without US dollar).

Let's take gold as an example. Considering its growth by 8,500 points from August to September 2017, you can invest money in a purchase. But only if your deposit can withstand large drawdowns. After all, having opened a deal, you will immediately find yourself in the red from 18 to 80 points! This is exactly how much the spread is for different brokers. The slightest rollback, and Stop Loss or Stop Out (lack of funds in the account) takes away your savings. (Fig.5)

Enlarge image

Other assets with high spreads (10 points or more):

- AUD/NZD – “audi”/“kiwi” (Australian dollar/New Zealand dollar);

- GBP/AUD – British pound/Australian dollar;

- GBP/CAD – pound/Canadian dollar;

- GBP/CHF – pound/chief;

- GBP/NZD – pound/New Zealand dollar (“kiwi”);

- EUR/AUD – euro/Australian dollar (“audi”);

- EUR/NZD – euro/kiwi;

- EUR/PLN – euro/Polish zloty;

- NZD/CAD – “kiwi”/Canadian dollar;

- NZD/CHF – “kiwi”/Swiss franc (“chief”);

- USD/MXN – US dollar/Mexican peso;

- USD/PLN – US dollar/Polish zloty;

- USD/RUB – US dollar/Russian ruble;

- USD/ZAR – US dollar/South African rand.

Stop Loss and Take Profit - how to set the levels correctly

Spread affects the execution of Take Profit and Stop Loss. But before we figure out how, let's understand these concepts. (Figure 6)

Enlarge image

Take Profit – an order to close a transaction upon receipt of a certain profit. Why is it needed? The price movement on the chart resembles steps. She cannot go in one direction all the time and jumps up and down, forming a corridor. The boundaries of this corridor are called support and resistance lines. The quote for them goes out very rarely and immediately comes back.

Therefore, the trader always places Take Profit in front of these lines. This is necessary to take profits before the price pulls back. How does the spread affect order execution?

It prevents the order from being closed at the specified price, automatically delaying execution by several points. As a result, the chart jumps onto the resistance/support line and reverses. And the trader is left with nothing!

A similar situation is with Stop Loss is an order to close a trade with minimal losses. Only here execution occurs before the price reaches the line you set. Again, by several points equal to the spread size.

How to deal with this? Set the spread value when calculating Take Profit and Stop Loss. That is, set Stop Loss a little further, and Take Profit closer.

How spread affects trading strategy

Spread does not affect the trading strategy if it is tied to long-term transactions (weeks and months). Indeed, in this case the price goes up to 10,000 points. Against their background, the same 250 points of the spread are lost without causing damage to the deposit.

Conversely, this type of deduction can reduce the profitability of short-term trading to zero. It knocks down closely spaced Stop Loss, which is typical for scalping. It prevents you from making money on news and eats up your profits from night trading.

Therefore, scalpers, as well as traders who trade on the night shift, need to search for a long time for a broker with suitable conditions for the assets of interest. And carefully check the current spread values.

Rebate services - how to return up to 90% of the spread

The spread on Forex is one of those pitfalls that have caused more than one thousand deposits to crash. But it turns out you can also make money on it! How? By registering in Rebate services.

These are Internet companies that are ready to return to the trader part of the funds he spent on spread. Brokers themselves offer a similar service, but the percentage there is much lower (about 15%).

Why charge the spread first and then give it away? This is a multi-move game, like in chess. The broker takes a commission from the trader. Then he enters into a partnership agreement with a rebate service to attract new clients for money. Next, the Rebate service advertises its services, attracting people to the broker’s company, and receives its reward. He pays part of it as interest on the spread. Everyone is happy!

conclusions

Let's summarize:

- Spread is the difference between the purchase price and the sale price, or in other words, the difference on the chart between the Ask and Bid lines.

- If the Ask price is not reflected on the chart, then correct it in the terminal settings

- The spread is measured in points.

- To determine the spread, 2 calculation systems are used.

- The size of the spread depends on the amount you are trading. The higher it is, the more deductions to the broker.

- The spread can be fixed or floating.

- The minimum spread usually occurs for highly liquid assets, such as the euro/dollar pair.

- High spread rates are usually set for exotic currency pairs.

- The size of the spread is also affected by the time of day, holidays and news releases.

- To protect yourself from spread spikes, always close trades before important news releases and regularly check the spread is up to date.

- The spread can be zero, but this does not always mean a benefit for the trader, because in this case the broker's commission comes into play.

- According to the study, only 30% of traders check the spread size before opening a trade.

- You can return part of the spread if you use rebate services.

- Spread influences the investor's trading strategy if it is based on scalping, cross pairs, gold or exotics.

- It reduces the likelihood of pending orders and Take Profit being triggered. And on the contrary, it increases the likelihood of hitting Stop Loss. Therefore, when setting these levels, include the spread size in them.

We hope our tips will help you avoid losses in the Forex market and make your trading strategy even more profitable. Like and don't forget to subscribe to new articles.

Video for dessert: Chic log lamp

The concept of spread. What is it in Forex and how does it affect trade transactions. How traders take into account spreads when trading on the forex market.

How does a broker make money – commission or spread? How to take into account the spread when placing stop loss and take profit orders. How to correctly calculate a transaction so as not to lose a single point in currency trading. We master the intricacies of stock trading on Forex.

Spread - what is it in Forex and how to work with it? Features and nuances

According to Wikipedia, a spread is the difference between the best buying and selling prices at some point in time.

Participants in speculative transactions on Forex are sellers and buyers - traders. But no transaction is possible without an intermediary - a broker. As you know, traders make money on exchange rate differences. A broker's earnings are a commission from traders' transactions. The size of the commission depends on the conditions of the intermediary. There are intermediaries offering a small spread or brokers without a spread. They are especially popular among those who use scalping trading tactics. In pursuit of maximum earnings, many traders compare spreads and other trading conditions.

How the spread works

When opening a tab for placing an order on the trading platform, the player sees 2 prices - one of them is valid for sell transactions, the other for buy transactions. These prices are not equal and the difference between them is called the spread. Its value may differ for different currencies - for currency pairs with high volatility, brokers most often set a minimum commission of 1-2 points. As a principle of operation of the banking system, in any bank the prices of currencies for sale and purchase differ from the rate set by the central bank. This difference in rates provides the bank with profit from exchange transactions.

The spread is the broker's profit from each open transaction, regardless of whether the player made a profit from entering the market or lost part of the deposit. Such a system for making a profit by a broker makes the company that provides the service of access to trading not interested in the result of the transactions opened.

The concept of spread. How to take it into account when placing orders

Even if the price has not moved a single point since entering the market, the current result of the transaction is still negative. Where the loss comes from - you can figure it out in this tutorial!

You should not be afraid or suspect the broker of fraud, although the transaction is “in the red” - this loss in the foreign exchange market is due to the spread. It is present on any currency pair and is an integral part of the playing conditions on the trading platform.

If you want to find out the size of the spread on a given currency pair, you can do this in one of the following ways:

- View in market overview;

- Open the tab for opening a deal to buy and sell a currency pair;

- Look in the contract description;

- The commission can be either fixed or floating. If there are no problems with the fixed spread - it is always the same, then the value of the floating spread is determined by the activity of the market - with a rapid rise/fall in price, the spread between Ask and Bid can increase to 10 or more points;

- Look in the “Properties” menu – “Show Ask line”, which will allow you to visually highlight the price spread between Ask and Bid, the level of the latter is indicated on the terminal by default.

To evaluate spreads for all currency pairs from different brokers, you should use a special comparison table on myfxbook.

Impact of the spread on trading

Forex commission must be taken into account both when opening a transaction and when closing it, if the player issues delayed TP and SL commands:

- If the sale is performed at the Bid price, then TP and SL orders are triggered at the Ask price;

- BYE trades are executed at the Ask price, while when closing TP and SL trades the Bid price is applied

Let's look at all this in practice:

- Open a BYE position on the EUR/USD currency pair. At the time of the conclusion of the trail, the Ask price is 1.1132. When setting a TP value of 30 points, the player should add the TP value to the Ask price, so we get a TP value of 1.1162. TP will work only after the Bid price reaches the specified value. Since the difference between Bid and Ask is 1 point - this is the spread value - in order for the transaction to be closed and the profit to be 30 points, it is necessary to count at the Bid price. A similar calculation algorithm is used for Stop Loss;

- When opening a SELL position, you need to count the TP and SL levels at the Ask price.

Calculating levels with an accuracy of one point is relevant when working on small timeframes, while when moving on hourly, daily, weekly and other charts, a difference of several points is insignificant, and there is no point in taking into account the difference between Ask and Bid prices.

Spread or commission?

When choosing a broker, it is worth finding out how he makes a profit, since in addition to the spread there are other options, for example, a fixed commission for each transaction - in this case there is no spread, and all transactions are opened at the same price. Such options are optimal for scalpers who make a profit of several pips per trade. As for the spread, it can be of the following types:

- Fixed – its value is always the same and is set individually for each pair of currencies;

- Floating – spread changes are carried out depending on such parameters as the popularity of the pair, time of day, market volatility, expected important market news, etc.;

- Spread + commission – opening a transaction involves a small commission and a fixed or floating spread; these options are the least common.

All details regarding spreads and commissions are specified in the agreement between the player and the broker. On average, the “cost” of the spread and the amount of the commission are approximately equal, but accounts with a commission are more attractive in terms of the accuracy of setting Stops and Take Profits. When working on small timeframes, it is worth choosing an account of this type. The loss of several points of price passage during scalping is especially noticeable; if the broker’s conditions require a floating spread, then scalping is not possible at all.